Student loan debt doesn't necessarily make it more difficult to qualify for a VA loan. However, it can impact your VA loan eligibility.

After mortgages, student loans are the nation's highest consumer debt category. In 2023, more than 43 million borrowers owed over $1.76 trillion in student loan debt - equating to nearly $30,000 in student loans per person.

So what happens if you have student loans and apply for a VA loan?

The good news is student loan debt doesn't necessarily make it more difficult to qualify for a VA loan. However, with the national student loan default rate at around 15%, staying on top of your student loans is critical when applying for a VA loan.

Here we'll take a closer look at VA loan guidelines with student loans and how this type of debt impacts your VA loan eligibility.

Can I Get a VA Loan with Student Loan Debt?

Yes, you can get a VA loan with student loan debt if you meet the financial criteria, including a satisfactory debt-to-income ratio.

» CALCULATE: Calculate your VA Loan savings

VA Loan Guidelines with Student Loans

The impact of student loans on your VA loan eligibility typically lands heaviest with the debt-to-income (DTI) ratio.

Lenders generally include your student loan payment when calculating your monthly debt-to-income (DTI) ratio. They'll also look for any signs that you've missed payments or defaulted on student loans, which can jeopardize your chances of securing a mortgage.

How Student Loans Affect Your DTI Ratio

With many federal student loan programs, you'll have a six or nine-month "grace period" once you're no longer taking a full course load. That'll give you some time to prepare financially for the cycle of loan payments that may run for years or even decades, depending on your specific situation.

But that grace period doesn't register the same way for mortgage lenders. They're going to want to know the exact amount of your pending student loan payments, and they'll absolutely look to factor student loan debt into your monthly DTI ratio.

Six months is a drop in the bucket compared to the 360 months that comprise a 30-year mortgage term, so student loan debt will affect your home loan, regardless of grace periods.

When Student Loans Count Against Your DTI

Policies can vary from lender to lender, but, in general, students loans will count against your DTI ratio if they are:

- Currently in repayment

- Due within 12 months of your closing date

- Currently in forbearance

- Deferred due to a financial hardship

VA Student Loan Debt Calculation

At Veterans United, we will count either the payment amount as it appears on your credit report or 5 percent of the overall loan balance divided by 12 months, whichever is greater. Borrowers whose actual monthly payment is less than that amount should talk with their loan officer about using that lower figure.

VA Loan Guidelines for Deferred Student Loans

Student loan deferment is also an option in some instances but may impact your VA loan.

Deferment is a temporary delay of your payments. There are a host of situations where you can apply for a deferment, including:

- You're enrolled at least half-time in college or career school

- You're serving on active duty

- Economic hardship

- Unemployment or under-employment

Do Deferred Student Loans Count Towards DTI?

VA homebuyers with student loans deferred for at least 12 months beyond the closing date can generally proceed without those student loans counting towards their DTI calculation, provided the deferment isn't related to financial hardship.

It's also important to know that forbearance and deferment are not the same things. Consumers typically have to request and be granted a deferment, which is a temporary delay of your principal and interest repayments.

Details and exceptions are extensive when it comes to student loan deferment and forbearance. You can learn more at the U.S. Department of Education's website.

Offsetting Student Loan Payments

It may also be possible in some cases to offset your student loan payment. Offsetting entails documenting income that essentially counterbalances the monthly debt. A lender could consider offsetting your student loan payment if:

- A co-signer on the loan made payments for at least the past 12 consecutive months without a late payment. In this instance, payments must be made by someone legally obligated on the loan.

- You have ten or fewer student loan payments remaining, and the payment is $100 or less.

Those are relatively narrow exceptions, although they do happen. In general, you'll need to plan on counting your student loan payment in your overall debt-to-income ratio calculation.

In addition, that monthly obligation will affect your overall residual income level, which also plays a critical role in qualifying for a VA home loan.

Still Have Questions About Student Loans with a VA Loan?

There are many ultra-specific situations that can crop up for VA borrowers with student loans. That's a big reason why it's essential to talk with a home loan specialist in detail about your particular situation.

Answer a few questions below to speak with a specialist about what your military service has earned you.

Related Posts

-

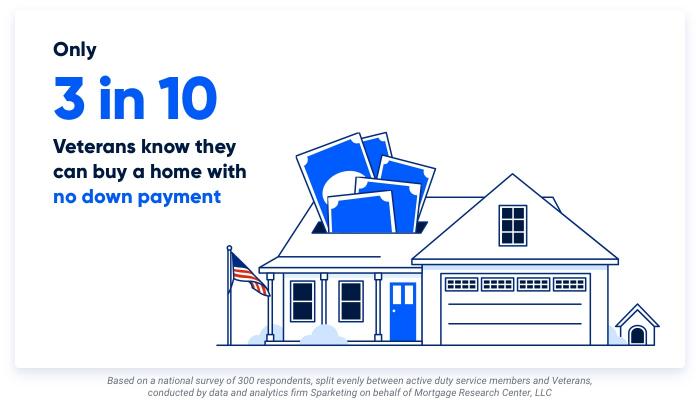

VA Loan Down Payment RequirementsVA loans have no downpayment requirements as long as the Veteran has full entitlement, but only 3-in-10 Veterans know they can buy a home loan with zero down payment. Here’s what Veterans need to know about VA loan down payment requirements.

VA Loan Down Payment RequirementsVA loans have no downpayment requirements as long as the Veteran has full entitlement, but only 3-in-10 Veterans know they can buy a home loan with zero down payment. Here’s what Veterans need to know about VA loan down payment requirements. -

VA Loan vs Conventional Loan: A Complete ComparisonHere we compare the primary differences between VA and conventional loans to show you when each option may be the best.

VA Loan vs Conventional Loan: A Complete ComparisonHere we compare the primary differences between VA and conventional loans to show you when each option may be the best.