A low VA appraisal doesn't mean the end of the road. VA buyers can appeal a low VA appraisal through VA Tidewater or a Reconsideration of Value (ROV).

The VA appraisal is a crucial, two-pronged step in the homebuying process.

One part of the appraisal reviews the property regarding general health and safety standards, known as the minimum property requirements. The other major piece of the VA appraisal is determining the home's value.

Receiving a lower-than-expected appraisal can be frustrating for homebuyers, so let’s talk about your options to challenge them.

What happens when a VA appraisal comes in low?

When a VA appraisal is lower than the agreed-upon purchase price, it means the property has been valued at less than what the buyer and seller have negotiated. A low VA appraisal doesn't mean the end of the road; VA buyers can appeal a low VA appraisal through VA Tidewater or a Reconsideration of Value (ROV).

VA Tidewater Policy

The VA's Tidewater process exists to combat low VA appraisals by allowing the appraiser to request additional comps and market data to support the sale price before finalizing the VA appraisal. The Tidewater policy is typically faster than an official reconsideration of value, as we'll see below.

VA Tidewater Process

The Tidewater process is relatively simple:

- VA appraisers notify the lender that the home's value will likely come in below the purchase price.

- Alerting the lender of the property falling under the contract price is known as invoking the "Tidewater Initiative," or Tidewater for short, as listed in VA Circular 26-17-18.

- The appraiser explains that the recent comparable home sales don't support the sale price.

- The lender has two days to provide the appraiser with additional comparable home sales that support the purchase price.

- Lenders typically turn to the buyer's real estate agent for help in finding good recent comparable sales.

- The appraiser will take those additional comps and issue the final appraisal report.

- If the Tidewater process doesn't lead to a sufficient increase in value, the appraiser must provide a written explanation as to why.

Typically, a lender's Staff Appraisal Reviewer, or SAR, issues a final Notice of Value (NOV) on the property based on the appraiser's report. The NOV makes the home's value official for the VA's purposes. Once the property's lower appraised value is official, buyers can seek a more formal appeal through what's known as a Reconsideration of Value (ROV).

What is a VA Loan Reconsideration of Value?

The Reconsideration of Value (ROV) is the formal process of appealing a low VA appraisal after the appraiser makes their determination.

There is no guarantee the ROV will increase the appraisal, but it at least gives buyers a shot at a higher appraisal value and a successful VA purchase. Talk with your lender about how best to proceed with a Reconsideration of Value.

Reconsideration of Value Process

The VA recognizes that appraisal mistakes can happen. Value-adding features can be overlooked, or suitable comps may have been left out. Appraisers might have mistakenly calculated square footage or used a comp in the original appraisal that isn't comparable (maybe recent renovations weren't known or factored into the equation). Reasons such as these are why the VA set up the Reconsideration of Value process.

The first part of the process is working with your lender and real estate agent to document the following:

1. Comps or market data that weren't in the initial appraisal

You can submit up to three recent comparable home sales not included in the original appraisal, which closed before the appraisal report's effective date. This information needs to be inputted into a Reconsideration of Value grid, and you'll need to include printouts from the Multiple Listing Service (MLS) for each of the comps. Also, write a brief summary of why these comps are better than the ones used by the VA appraiser.

2. Evidence of errors

Have your agent scrutinize the original appraisal report. Does the report contain faulty information? Were old sales used? Are all comps similar to the subject home in size, age and condition? You'll need both a narrative summary outlining the perceived problems and evidence to support your claims.

3. A letter from the borrower

The letter is a written request for the Reconsideration of Value with the borrower's thoughts on why the appraised value should be increased and what they think the value should be.

The next step is submitting your ROV request to the correct VA Regional Loan Center for review. You’ll work with your loan officer to complete this step of the process.

The final step is waiting on the VA to make a determination. If there ROV fails, you still have a few options.

How Long Does a VA Reconsideration of Value Take?

A VA Reconsideration of Value typically takes no more than a few days but can take up to several weeks in some cases. There are many factors to take into consideration, so wait times for a ROV may vary.

What if the ROV Fails?

Every homebuying scenario is different, but appraisal values can be tough to predict and tough to challenge. Buyers can be crushed upon learning that the Reconsideration of Value has been denied.

You typically have three options if that happens:

1. Ask the seller to lower their asking price

You can point to the low valuation and suggest the seller’s home isn’t worth quite what they were hoping. Not all sellers will bite, but it might be an option worth exploring depending on your situation. Talk with your real estate agent about how best to negotiate a lower purchase price.

2. Make up the difference in cash

Buyers can pay the difference between the purchase price and the appraised value out of pocket. This isn’t always easy or without risk -- part of the consideration is do you want to pay more than a home might be worth? If you ultimately decide to make up the difference in cash, you may be able to lower your VA Funding Fee if you’re putting down at least 5 percent.

3. Walk away from the deal

VA loans protect a buyer’s earnest money if the home fails to appraise. This safeguard comes in the form of a unique document called the VA Amendment to Contract, which allows prospective buyers to get their earnest money deposit back if the appraisal comes in low.

Talk with your loan officer if you have questions about VA appraisals and how to handle a low valuation.

Cross Your Fingers

Appraisal values can be tough to predict (and tough to challenge). What’s certain is that with so many military buyers choosing the 100 percent financing offered by VA loans, a low appraisal value can be a devastating surprise.

There is no set time for how long the ROV process may take but beyond a solid CMA and a good contract, there’s little to do besides wait and hope for the best. With a little luck, your client’s appraisal value will meet or exceed the VA loan value, and you’ll soon be celebrating your latest sale.

Answer a few questions below to speak with a specialist about what your military service has earned you.

Related Posts

-

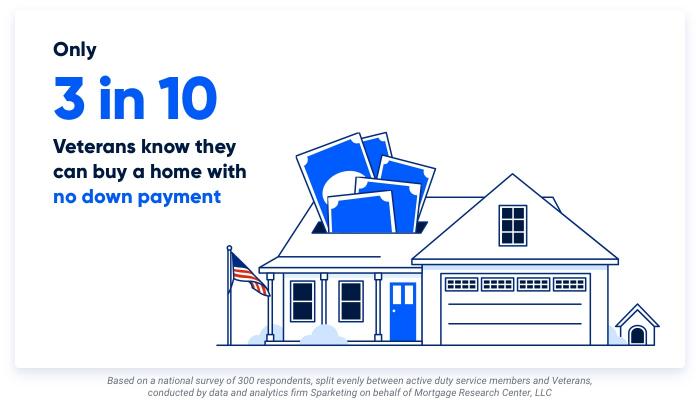

VA Loan Down Payment RequirementsVA loans have no downpayment requirements as long as the Veteran has full entitlement, but only 3-in-10 Veterans know they can buy a home loan with zero down payment. Here’s what Veterans need to know about VA loan down payment requirements.

VA Loan Down Payment RequirementsVA loans have no downpayment requirements as long as the Veteran has full entitlement, but only 3-in-10 Veterans know they can buy a home loan with zero down payment. Here’s what Veterans need to know about VA loan down payment requirements. -

VA Loan vs Conventional Loan: A Complete ComparisonHere we compare the primary differences between VA and conventional loans to show you when each option may be the best.

VA Loan vs Conventional Loan: A Complete ComparisonHere we compare the primary differences between VA and conventional loans to show you when each option may be the best.