Veterans and military members may be able to purchase a VA home loan using income from a revocable living trust. They may also be able to place their VA mortgage into a living trust.

What is a living trust?

A revocable living trust–also known as an ‘inter vivos trust’ is a legal arrangement that allows an individual (the grantor) to transfer their assets into a trust during their lifetime. The grantor typically serves as the initial trustee, maintaining control over the trust assets and retaining the ability to amend or revoke the trust at will.

The primary purpose of a living trust is to facilitate the seamless management and distribution of these assets to designated beneficiaries after the grantor's death or incapacity, bypassing the often lengthy and costly probate process.

Can I put my VA mortgage into a living trust?

With your lender’s approval, you may place your VA mortgage into a revocable living trust while still making payments. This would automatically transfer the property to your successor trustee upon your death or incapacitation.

Though guidelines vary by lender, here are some common requirements when placing a mortgage into a living trust:

- The trust must be revocable – meaning the grantor (person who creates the trust) retains the ability to make changes or revoke the trust during their lifetime.

- The grantor must hold the position of trustee in the revocable living trust (though additional trustees may be named).

- The property is residential.

If you are considering this option, seeking an attorney specializing in real estate planning is recommended.

» CALCULATE: Calculate your VA Loan savings

Benefits of a Living Trust

The primary benefit of a living trust is the avoidance of probate, which can be time-consuming, costly, and public. Placing assets in a trust allows them to be transferred to beneficiaries more efficiently and privately after the grantor's death. Additionally, living trusts can provide greater control over asset distribution, potential tax benefits, and the ability to manage assets in the event of incapacity.

Using Trust Income to Qualify for VA Loans

If you are the beneficiary of a trust, lenders may be willing to count your trust money as effective income toward VA mortgage qualification. You are more likely to be granted this permission if you prove your trust income is stable and consistent. However, guidelines and policies can vary by lender.

Veterans United Guidelines for Using Trust Income on a VA Loan

To consider trust income for a VA Loan at Veterans United, we would need to see the documentation confirming payment amount, frequency, and duration. If the documents don't clearly define the amount, we'll typically use a 24-month average based on tax paperwork.

The income must be expected to continue for the next three years.

You Must Provide Sufficient Trust Documentation

In addition to evaluating credit, debts, and assets, underwriters will read over trust documents with a checklist.

Here are some items that Veterans United underwriters are looking for when evaluating a borrower's trust documentation:

- The trust beneficiary is a Veteran who meets VA loan eligibility guidelines.

- The title insurance protects the lender fully, and the property title is fully vested in the trustee's name.

- The property is a single-unit, owner-occupied primary residence by at least one of the people who created the trust.

- The trustee is authorized to borrow money and obtain real property.

- Verification that the trust isn't a fictitious or blind trust or a life estate

Verification by an Attorney is Required

Veterans United underwriters must also see a title attorney's opinion letter regarding the trust documentation. These legal documents evaluate the legality of the trust and whether its assets can be used to obtain a home loan.

The attorney's letter needs to reflect that in their opinion:

- The trust was validly created and duly exists under applicable law

- The trust is revocable

- The borrower is the creator and beneficiary of the trust

- Trust assets can be used as collateral for the loan

- The trustee is fully authorized under the trust documents and applicable law to pledge or otherwise encumber the trust assets

Every trust situation is different. Talk with a Veterans United VA Loan Expert if you have questions about getting a VA home loan using a revocable living trust or if you are considering placing your VA mortgage into a revocable living trust.

Answer a few questions below to speak with a specialist about what your military service has earned you.

Related Posts

-

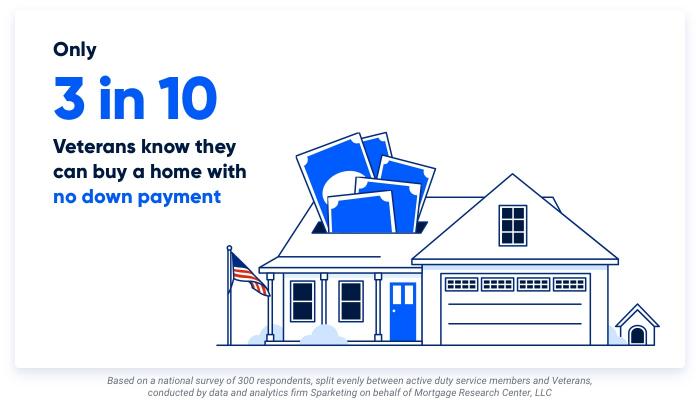

VA Loan Down Payment RequirementsVA loans have no downpayment requirements as long as the Veteran has full entitlement, but only 3-in-10 Veterans know they can buy a home loan with zero down payment. Here’s what Veterans need to know about VA loan down payment requirements.

VA Loan Down Payment RequirementsVA loans have no downpayment requirements as long as the Veteran has full entitlement, but only 3-in-10 Veterans know they can buy a home loan with zero down payment. Here’s what Veterans need to know about VA loan down payment requirements. -

VA Loan vs Conventional Loan: A Complete ComparisonHere we compare the primary differences between VA and conventional loans to show you when each option may be the best.

VA Loan vs Conventional Loan: A Complete ComparisonHere we compare the primary differences between VA and conventional loans to show you when each option may be the best.